Claude for Finance: Strategic Expansion & the Power of MCP

Digging into how the Model Context Protocol powers Claude's new tools for financial analysis, and what that means for other players

What Happened This Week in MCP

It’s been a big (huge) week for the Model Context Protocol:

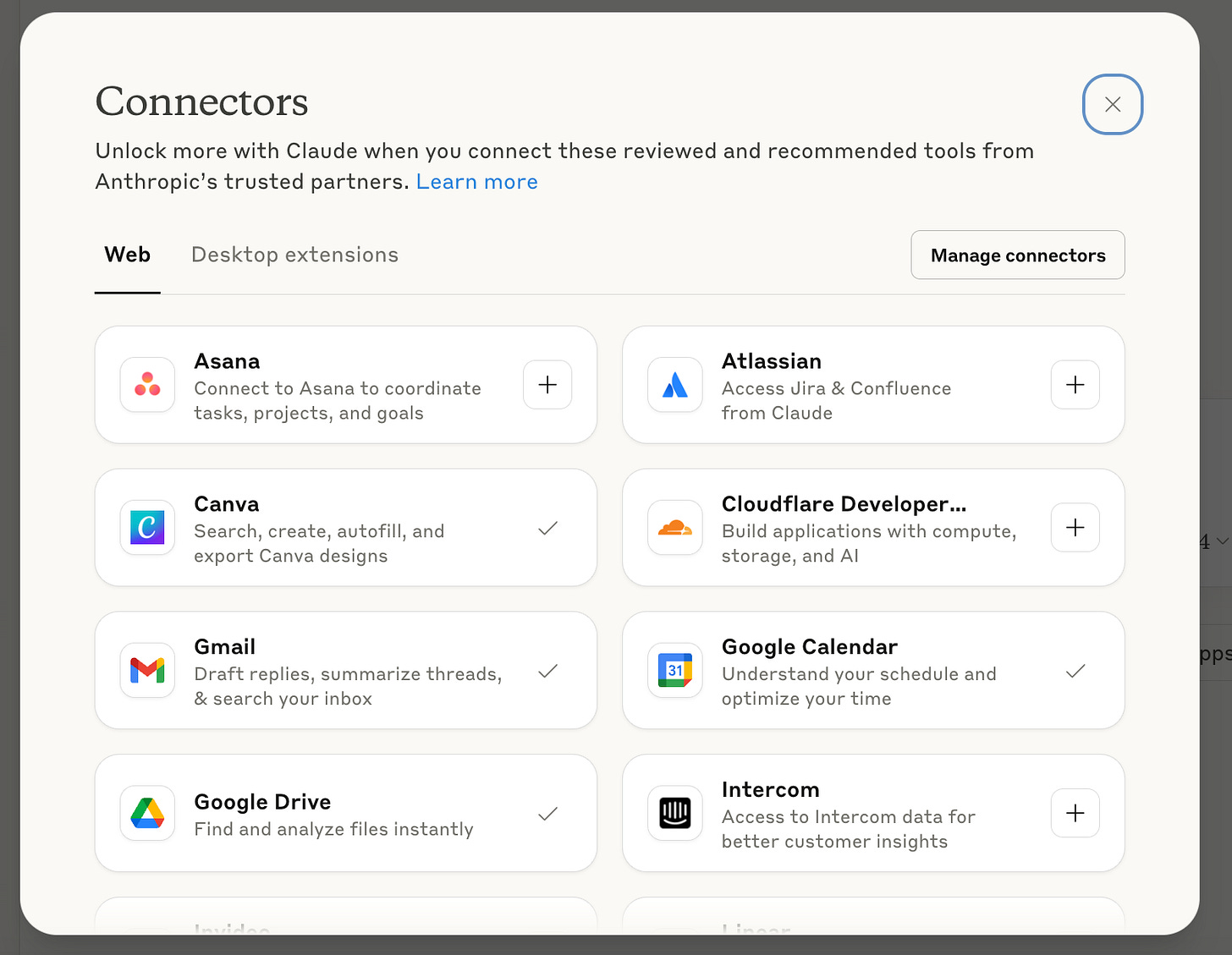

Anthropic launched a new directory of MCP servers, now with one-click install, bringing them up to par with OpenAI and Cursor on ease-of-use.

In the process, they rebranded MCP servers from “Integrations” to “Connectors”, matching OpenAI’s terminology.

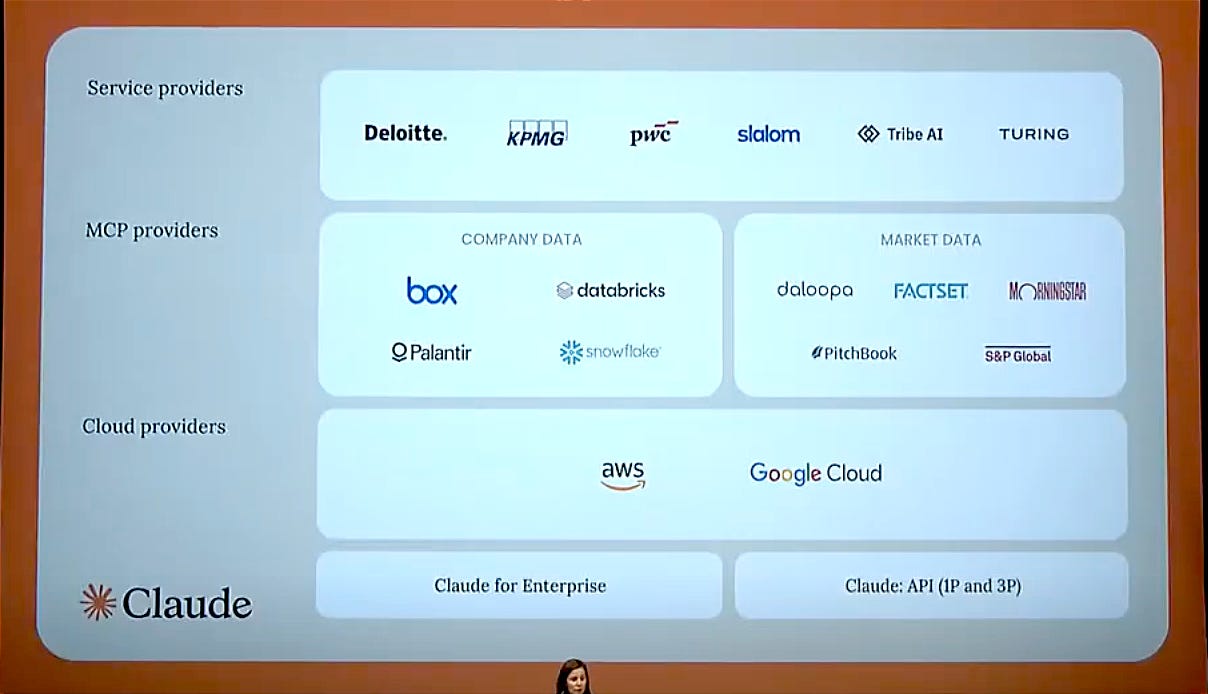

Anthropic also introduced Claude for Financial Services, a financial analysis platform powered by MCP connectors to both internal company data (e.g. Databricks) and financial data providers (e.g. S&P Global).

The MCP open-source project shared their go-forward Governance Model, outlining the core team and process for future protocol changes.

Each of these is notable and worthy of deeper exploration (and I’ll likely write about the governance model next week). But today, let’s dig into Claude for Financial Services—what it is, Anthropic’s strategy, and why MCP is so critical.

Claude for Finance: What It Is and Why It Matters

Anthropic published a launch blog post and accompanying Keynote that show off the core functionality of Claude for Finance. Below is a summary and some highlights. TL;DR - I was impressed, and it could ace my Finance 2 exam. And it’s all powered by MCP servers.

What can Claude for Finance do?

Anthropic demo’ed three different use cases:

Summarizing recent earnings reports

Creating a Discounted Cash Flow model to estimate a fair share price (this one’s especially worth watching)

Drafting an investment memo

Screen recordings of each below (but watch the actual Keynote if you want the voiceover).

I thought all of these were really cool, but the DCF model demo (similar to the viral videos from an early-stage startup called Shortcut) is particularly impressive to me. Equipped with up-to-date financials brought in via MCP connectors, the LLM is able to create a multi-tab Excel model with linked formulas. But the MCP connection is key here: providing structured financial data that forms the basis for the analysis, and allows the LLM to cite its sources.

Summarizing recent earnings reports

Creating a Discounted Cash Flow model to estimate a fair share price

Drafting an investment memo

How does Claude for Finance work?

Interestingly, Claude for Finance isn’t a separate software product. It’s a curated experience built from tools already available in Claude, bundled with data integrations tailored to finance professionals:

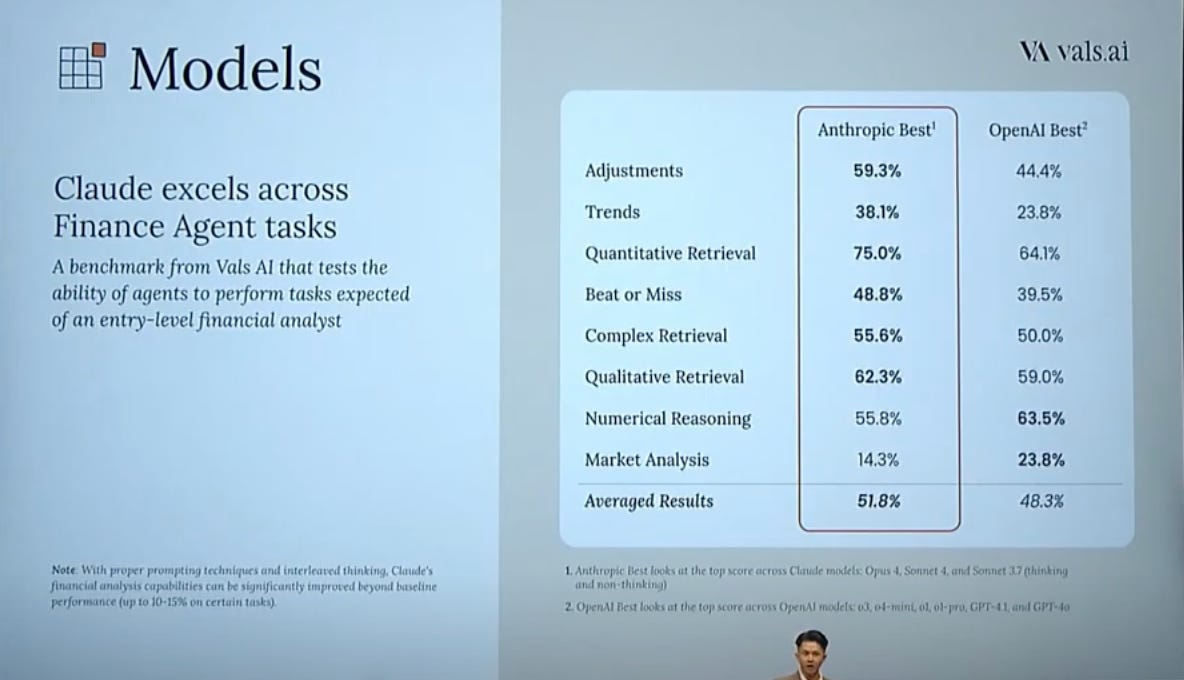

Claude chat interface with access to Anthropic models like Sonnet and Opus, which perform well on quantitative and financial reasoning

Claude "artifacts" and file exports: dashboards, reports, and downloadable Excel files embedded in chat

MCP servers (“connectors”) that bring in structured data from internal sources (e.g. Snowflake, Box) and external providers (e.g. Factset, Pitchbook)

Here’s the full set of launch partners:

Claude also supports source-level citations, which enhance user trust by linking responses back to original systems. Finally, they’ve partnered with service providers like Deloitte to help with implementation and get customers up and running quickly.

The result doesn’t feel very different from the ChatGPT or Claude experience we’re all used to - but putting it all together, particularly with the new MCP server partnerships to integrate financial data, is a really powerful combo.

Anthropic’s Strategy: Vertical Expansion Enabled by MCP

Each of the major LLM providers has carved out a distinct reputation:

OpenAI: Best for consumers

Anthropic: Best for developers

Google: Best infrastructure (also, bad at delivery)

Anthropic’s focus on developer use cases has led to models that are especially good at consistent reasoning, math, and structured analysis: traits that translate directly to finance.

(The keynote, delivered to a room filled with New York finance professionals, put a LOT of emphasis on how Anthropic outperforms OpenAI in tasks like market analysis and quant finance tasks.)

But model quality is only part of the story. Anthropic also has another structural advantage in that they are the creators of the Model Context Protocol.

MCP is an open standard, and a big part of the point is that it’s interoperable across different LLMs. It works just as well with OpenAI’s models as with Anthropic’s.

However, as the originators of MCP, Anthropic is best positioned to support companies building MCP connectors — and to then be first in line when those integrations are ready for launch. That’s a meaningful structural edge.

In short: Anthropic has already built the best infrastructure for developers (so far). Now they’re applying that same playbook to finance.

What does this mean for other finance AI tools?

This feels to me like an early glimpse of the strategic shift I wrote about in MCP’s Winners and Losers:

Model providers (e.g. Anthropic) and data owners (e.g. S&P Global) are positioned to win.

Vertical tools (e.g. AI SaaS for Finance Professionals) without proprietary data of their own are at risk

For Vertical Finance SaaS

Companies like Alphasense and Hebbia offer products that layer AI search and chat on top of equity research, earnings calls, and finance data rooms.

They have a meaningful head-start: Alphasense and Hebbia are already multi-million dollar businesses with loyal customers and deep industry expertise. But as Anthropic is making clear, a powerful model and relevant MCP servers can get you 90% of the way there, really fast - and without the need to switch tools.

An Alternate Example

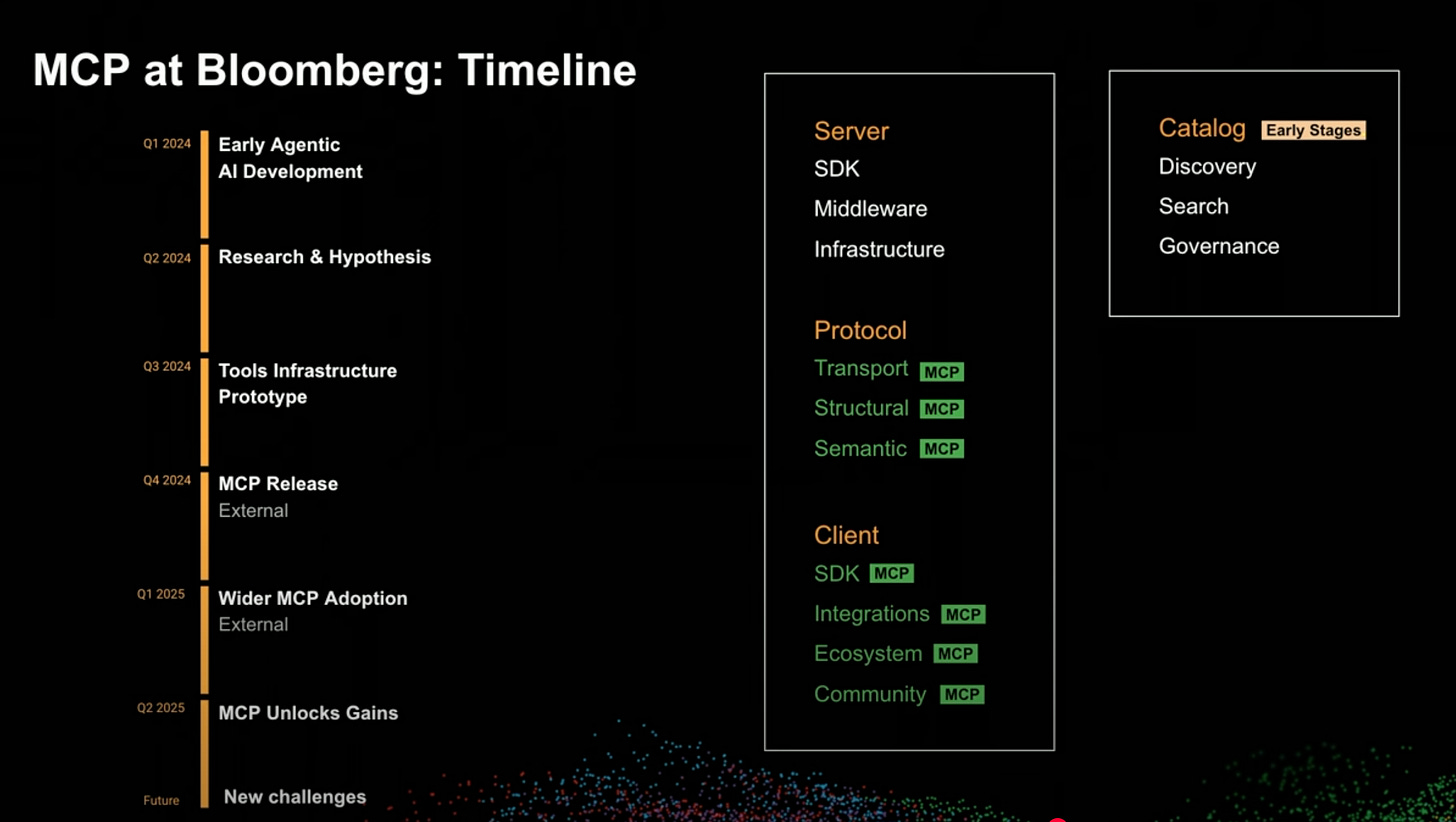

This makes Bloomberg’s AI investments feel very wise. Because they have proprietary data themselves, they’ve used it to build up their ability to both be their own model provider, and offer their own MCP tools.

They announced BloombergGPT, a model trained specifically on finance data, in March 2023. They’ve been experimenting with MCP servers and tool-calling since early 2024. Bloomberg’s AI tools can already do several of the things Anthropic is now piloting, like search earning call transcripts and analyst reports to provide synthesized insights, with citations.

Because Bloomberg has both models and proprietary data, and are using them in tandem, they still get to be the interface, not just a connector. Others, like S&P Global, still own the critical data, but risk being relegated to being a tool in someone else’s interface.

Takeaways

Claude for Financial Services is a high-stakes demo of what’s possible when strong models meet trusted data via MCP connectors.

Anthropic’s vertical expansion strategy leverages their core advantages: model quality/specialization and MCP leadership.

Finance SaaS tools without proprietary data will need to move quickly to stay differentiated, likely through partnerships, UX, or domain-specific enhancements

Other industries should take note: the interface layer is being redefined. MCP is at the center of that shift.